Finance Signals from the Vault

Alright, let's talk Jupiter (JUP). Seems like everyone's got an opinion, but few are actually digging into the numbers. Is it just another flash-in-the-pan pump-and-dump, or is there real potential lurking beneath the surface? I’ve seen this movie before – early hype, followed by a brutal correction. The question is, does Jupiter have a second act?

JUP: From $2 to Zero (Almost) in 24 Hours

Initial Performance and Volatility

The data paints a mixed picture, to say the least. Launched in January 2024 with a massive airdrop (classic tactic to generate buzz), JUP hit an all-time high of $2 almost immediately. A day later, it crashed back down to earth, losing 75% of its value. That kind of volatility isn't unusual in crypto, but it's a bright red flag for anyone looking for stability.

Jupiter: Savior of Solana or Just Another Shiny Toy?

Solana's DEX Aggregator: Real Utility or Just Hype?

Jupiter bills itself as a key trading tool within the Solana ecosystem, a DEX aggregator that finds the best swap prices. Okay, that sounds good on paper. Solana *does* have a liquidity fragmentation problem, and an aggregator could solve that. But is it *actually* solving it?

Jupiter: Half the Volume, But Half the Story?

Market Share and Trading Volume Analysis

Let's look at trading volume. The article mentions that Jupiter secured more than half of all trading volume on Solana after three years of development. Half sounds impressive, right? But "more than half" could mean 51%, or it could mean 90%. We need specifics. What's the trend? Is that market share growing, shrinking, or flatlining? Details are suspiciously scarce.

Jupiter's Edge: Razor-Thin or Game-Changing?

Questioning Jupiter's Competitive Edge

Here's where my skepticism kicks in. The article highlights Jupiter's routing engine, which scans DEXs for the best swap path. But how much better are these paths, really? Are we talking about saving fractions of a cent per trade, or are there significant cost advantages? Again, no concrete numbers. If Jupiter’s edge is marginal, its long-term value proposition becomes questionable.

Jupiter's Revenue vs. Plummeting Market Cap: A Disconnect?

Revenue vs. Market Cap Discrepancy

And this is the part of the report that I find genuinely puzzling: the disconnect between fundamentals and token performance. The article quotes Blockworks noting Jupiter generated $45 million in revenue in Q3 2025, putting it on track for $180 million annualized. That's real money. So why has the market cap plummeted from $3 billion to $1.1 billion? Either the market is massively undervaluing Jupiter, or those revenue numbers are… optimistic.

Forecast Frenzy: When "Experts" Disagree by 600%

Conflicting Price Predictions

The forecasts are all over the map, too. Telegaon is wildly bullish, projecting JUP to reach $5.29 by the end of 2025, while DigitalCoinPrice is far more conservative, suggesting a maximum of $0.75. That's a discrepancy of over 600%. When the experts can't agree, it's a good sign to tread carefully. Jupiter Price Prediction: 2025, 2026, 2030-2040

Technicals Agree: No Bullish Case Here

Technical Analysis and Market Sentiment

Investing.com's technical analysis isn’t encouraging either. The overall technical summary signals a "Strong Sell," with most indicators pointing towards weakness. Monthly moving averages are bearish, and the RSI sits in neutral territory. There's simply no clear bullish momentum on the horizon.

Hacked Confidence: When Perception Becomes Reality

Security Concerns and Social Media Hack

One thing that gives me pause is the report that Jupiter’s social media account was hacked in February 2025, triggering an 8% price drop. While no funds were lost, that kind of event erodes confidence. In the volatile world of crypto, perception is often reality.

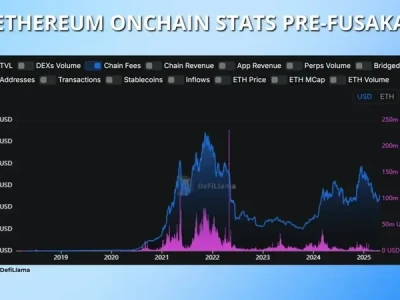

Fusaka Upgrade: Band-Aid or Real Fix?

Upcoming Fusaka Upgrade

Jupiter is supposedly addressing this with the upcoming Fusaka upgrade in December 2025, which should enhance blob capacity and lower operational costs. They are planning to increase the block gas limit from 45 million to 150 million gas units, increasing throughput from 15-20 TPS to around 45-60 TPS. But will these changes make a tangible difference to the average user?

Solana's Success: Jupiter's Lifeline, or Achilles Heel?

Reliance on Solana's Ecosystem

The article also mentions the importance of the Solana network's growth. That's true, but it's a double-edged sword. Jupiter is heavily reliant on Solana's success. If Solana falters, Jupiter goes down with it.

JUP: Potential, Risks, and Unanswered Questions

Conclusion: Potential vs. Risk

Look, Jupiter has potential. It's a key player in the Solana ecosystem, and its DEX aggregator could be valuable. But there are too many unanswered questions and too much reliance on future growth. The tokenomics need a closer look, the revenue numbers need verification, and the reliance on Solana's success is a significant risk factor. Until I see more concrete data, JUP remains a speculative play, not a long-term investment.